Hard Money Lenders in Atlanta: Unlock Fast Financing for Real Estate Projects

Hard Money Lenders in Atlanta: Unlock Fast Financing for Real Estate Projects

Blog Article

Top Benefits of Picking Tough Money Lenders for Your Realty Investment

Tough cash loan providers present an engaging alternative to typical funding techniques, offering advantages such as fast accessibility to resources and versatile car loan terms. Furthermore, the less strict credentials demands can open up doors for a wider array of financiers.

Quick Access to Capital

Usually, investor deal with time-sensitive chances that need immediate funding, making quick access to resources essential. Traditional financing approaches, such as financial institution finances, typically include prolonged approval procedures that may hinder a financier's capacity to act quickly in competitive markets. In comparison, tough cash loan providers provide a streamlined method to financing, permitting capitalists to secure necessary capital in an issue of days, as opposed to weeks or months.

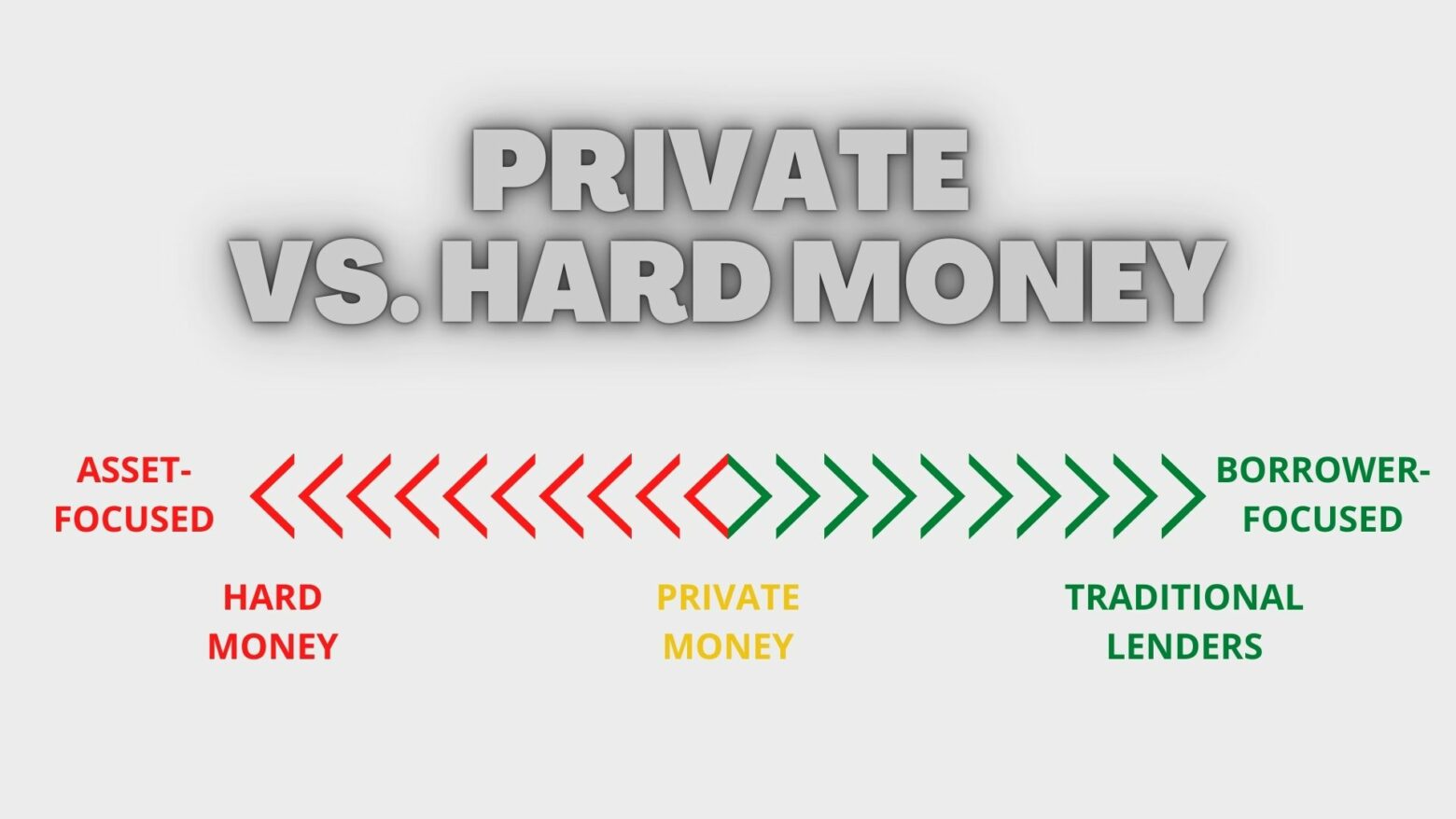

Difficult money finances are mostly based upon the worth of the residential or commercial property instead of the credit reliability of the customer. This asset-based borrowing allows investors to bypass the extensive documents and credit rating checks generally needed by standard loan providers. Because of this, investors can seize lucrative opportunities, such as troubled homes or public auction purchases, without the restraints enforced by traditional funding.

Furthermore, the rate of tough money financing can promote rapid job initiation and turnaround, eventually boosting a capitalist's potential returns. With the capacity to access funds promptly, investor can stay competitive, take advantage of market variations, and apply strategies that enhance success. This dexterity in financing placements tough cash lenders as an important resource for those navigating the dynamic landscape of property financial investment.

Adaptable Car Loan Terms

The adaptability of hard cash loans expands beyond fast access to funding, as they additionally use flexible loan terms that cater to the distinct demands of real estate financiers. Unlike typical funding options, which frequently enforce stiff structures and lengthy durations, tough cash loans enable for customization in payment routines, car loan amounts, and rates of interest.

This versatility is particularly beneficial for capitalists who might call for tailored services based upon task timelines or capital factors to consider. A capitalist looking to refurbish a residential or commercial property might opt for a temporary loan with a balloon settlement at the end, lining up the repayment with the anticipated sale of the building after remodellings.

Moreover, tough money loan providers are typically ready to work out terms based on the certain threat account of the investment, which can result in a lot more desirable problems than those generally readily available through standard loan providers. This degree of adaptability not just encourages capitalists to make educated economic choices yet additionally improves their capacity to take chances in a vibrant genuine estate market. Overall, the adaptable financing terms related to tough cash loaning can considerably add to the success of actual estate investment ventures.

Streamlined Authorization Process

Just how can actual estate capitalists profit from a streamlined approval process when seeking funding? In contrast, difficult money lending institutions prioritize speedy assessments, allowing financiers to obtain financing in a matter of days instead than weeks.

This expedited read what he said process is especially helpful in competitive realty markets where timing is important. Capitalists can secure homes before they attract several offers, thereby maximizing their opportunities of success. hard money lenders atlanta. Additionally, the streamlined authorization procedure decreases governmental obstacles, permitting financiers to concentrate on their purchase methods instead of obtaining bogged down by documents.

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

Much Less Rigorous Qualifications

Tough money lenders mostly concentrate on the value of the residential property as opposed to the customer's debt history or revenue. This asset-based financing design makes it possible for capitalists that may not qualify for conventional lendings to access the essential funding for their tasks. Furthermore, difficult cash loan providers typically need less paperwork, simplifying the application process and reducing the moment required to protect my website funding.

This versatility is particularly advantageous for financiers looking for to exploit on time-sensitive opportunities, such as affordable auctions or troubled residential or commercial properties. By lessening the obstacles to entry, hard money lending institutions empower a wider series of investors, including those with less-than-perfect credit rating or unusual financial backgrounds. As a result, this access fosters a more vibrant property market where diverse investment strategies can prosper.

Chance for Greater Returns

Capitalists leveraging tough cash lendings usually find a method for possibly greater returns on their property ventures. Unlike conventional financing paths, difficult money car loans are usually based upon the residential property's value as opposed to the borrower's credit reliability, permitting capitalists to act quickly in competitive markets. This rate is vital; chances frequently disappear swiftly, and the ability to shut deals quickly can bring about helpful acquisitions.

In addition, tough money loans are frequently used for fix-and-flip projects. Financiers can acquire distressed residential or commercial properties, remodel them, and after that sell them at a costs, profiting from the market's need for upgraded homes. The quick access to resources allows financiers to make best use of earnings margins, as they can reinvest their incomes right into added projects without prolonged delays.

Furthermore, considering that tough cash loan providers concentrate on the asset's worth, investors can leverage their equity in the residential or commercial property to safeguard discover this larger finances, enhancing their potential returns. By using this funding technique judiciously, actual estate financiers can not just improve their cash money flow yet additionally develop equity in time, ultimately positioning themselves for greater monetary success in the competitive landscape of genuine estate financial investment.

Verdict

Finally, tough cash lending institutions existing unique advantages genuine estate capitalists, including rapid access to funding, adaptable financing terms, an efficient authorization procedure, and much more tolerant certification standards. These advantages not only assist in swift decision-making but likewise deal with a more comprehensive array of capitalists, inevitably promoting opportunities for improved returns. By leveraging these features, financiers can purposefully position themselves to utilize on time-sensitive possibilities within the vibrant genuine estate market.

In contrast, hard cash lending institutions supply a streamlined strategy to funding, permitting financiers to protect needed resources in a matter of days, instead than weeks or months.

By picking difficult cash loan providers, actual estate capitalists can utilize rate as an essential benefit in their financing endeavors.

Capitalists leveraging difficult cash loans commonly discover an opportunity for possibly greater returns on their genuine estate endeavors.In final thought, tough cash lending institutions existing distinct advantages for actual estate financiers, consisting of fast access to resources, adaptable car loan terms, a reliable approval procedure, and much more tolerant certification standards.

Report this page